Thank you John Hancock for sponsoring this post!

When it comes to finances and planning for your future, will anyone be ready for retirement, when the time comes? For us, Jason handles the day to day bill pay and bookkeeping, because oddly enough, he actually enjoys the numbers. With that, are we really ready for our future?

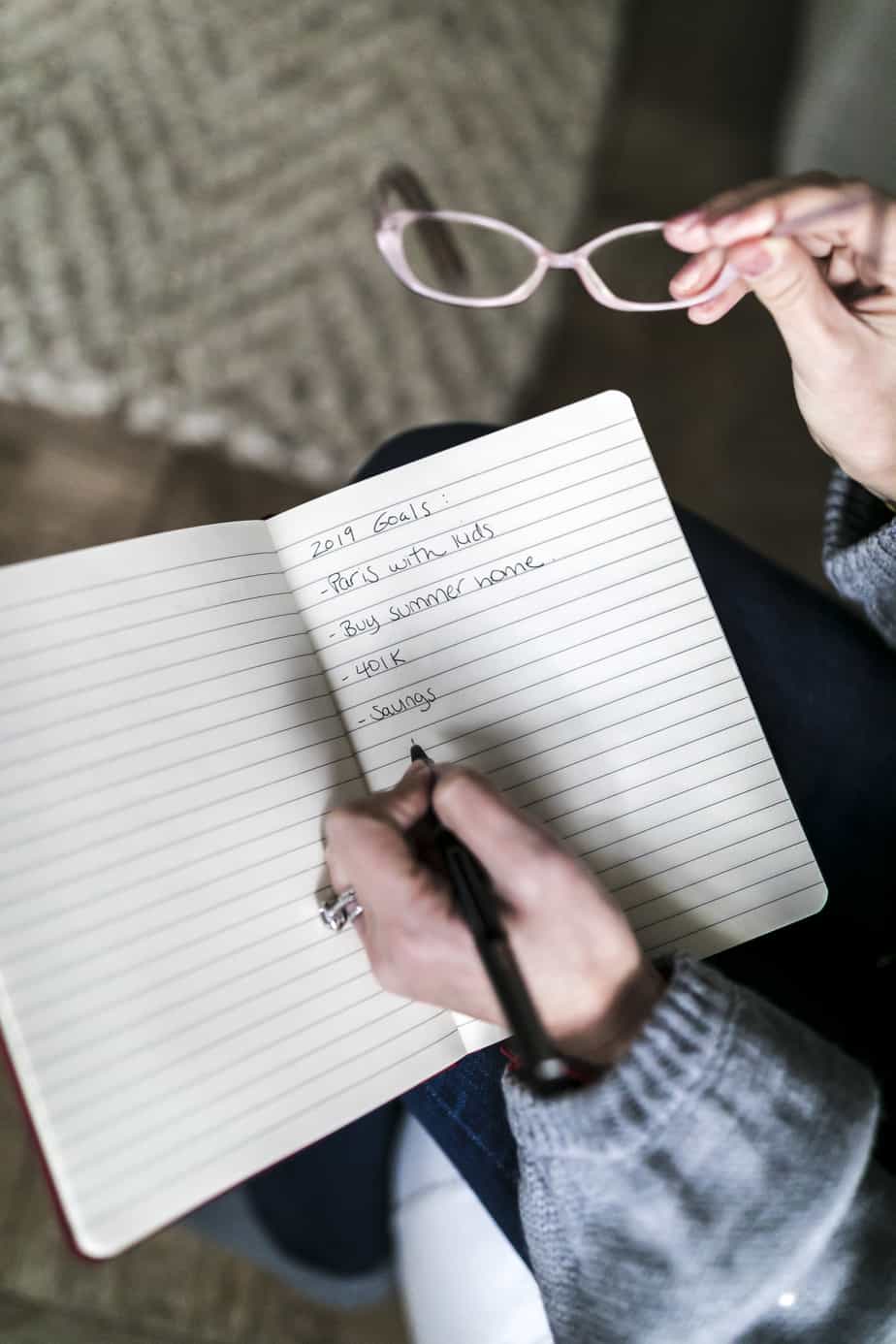

I have to say over the years, we have become pretty fiscally responsible. Which is a monumental shift from the behavior from when I was in my twenties. As I grew older and wiser (I hope), I learned the importance of saving. Together, Jason and I make a point to set aside funds for the kids’ colleges, a little stash for traveling. Our ultimate goal this year is to buy a weekend home, which you know has been my dream for the past few years. Some self-preparation was good, but finally we thought we could benefit to speak with a professional, to ensure that we were on the right path. After all, coming off a birthday yesterday, we need to start thinking about those golden years!

Retirement and future, whenever I’ve heard those words I felt like I was too young to start thinking about that, but truth is I don’t think any age is too early to start considering plans for the future. Sure investing in your future can seem like a burden on your current way of life. But when you take control of your finances, the process can be freeing and bring on serious serenity. With this in mind, Jason and I decided to have a consultation with a professional at John Hancock to learn about financial planning.

Buying a home has been our dream for years now, and to be honest the process has become super frustrating. We’ve looked at plenty of houses, and even submitted offers. In the end, it seemed like there was always something wrong with the house. Lets face it, unless you’re buying something brand new built to your specs, every house needs a little work, so looking back, we realize the problems weren’t with the houses. The thought of using all of our savings for college, summer vacations, rainy days and retirement worried us. This cycle has been going on for what feels like forever, and it was time to make a change.

Last week, we chatted with Misty, a John Hancock financial advisor who works with people of varying life stages, like buying a house. After my conversation with Misty, Jason and I felt newly empowered with knowledge and financial planning strategies.

Here are a few tips that anyone could consider:

Create separate bank accounts for your goals. For example, travel savings should not be kept together with your savings for a new home.

When purchasing a new home, consider getting a pre-approved letter from your bank. This may help when you are bidding against someone else.

Many people don’t realize that money you stash away in your child’s 529 fund can also be used to pay for middle school and high school.

Teach your children now the importance of saving money.

Make sure to have at least 20% of the purchase price of a house available to use as a down payment which will help decrease your mortgage payments.

It was so informative speaking with a John Hancock financial advisor, and we certainly learned a lot from the conversation. Would love to hear your financial planning dreams and goals this new(ish) year!

15 thoughts on “An Investment In Knowledge!”

Having a financial advisor is so important. There are so many things out there that might seem like a great idea but really aren’t for your situation. it also helps to have someone guide you as to how to properly save.

Good luck reaching your goal of getting a summer home! It’s a fantastic goal to strive for.

We’ve strived to teach our children about the importance of managing money. A financial advisor has definitely come up as a suggestion for once they start working full time. Money is difficult to manage, and costly to make mistakes with after all.

This is very inspiring, thanks a lot for sharing. I need to take my financial planning very seriously.

These are such great tips. I am always looking for new ones when it comes to finances.

Lovely reading your nice bucket list to manage finances and plan for future.

Those are some great tips, especially creating separate bank accounts. It is so important to be knowledgeable about these things. I hope you manage to get your summer home this year.

These are some great tips; always a good idea to think about finances early on in life than to wait and think you can always catch up.

We have a separate account that pays our mortgage. The rest of our income goes in to a joint account for us to pay bills, but knowing our home is taken care of, is reassuring!

These are definitely some great goals. I would love to check out this financial advisor.

I so struggle with managing the budget! You have shared some amazing tips, I really need to consult with a professional to manage finances.

Great goals. Am struggling with financial management

My goal is to teach my kids to invest their own money. and that is really an important things to do.

You are so right that it’s not too early to be thinking about retirement, and building a nest egg as one of your goals. We recommend an excellent book, Rewirement by Jamie Hopkins, that gives you a great roadmap for the years leading up to it. We’re almost there and we’re glad we’ve had a decade or two to plan for it. That means we actually get to retire, which isn’t a given these days.

I definitely need to start getting better at planning ahead and setting goals. Everyone could use some advice like this.